Bitcoin as a Risk Free Asset

Published on 07/21/2021 01:57 PM

Bitcoin as a Risk-Free Asset

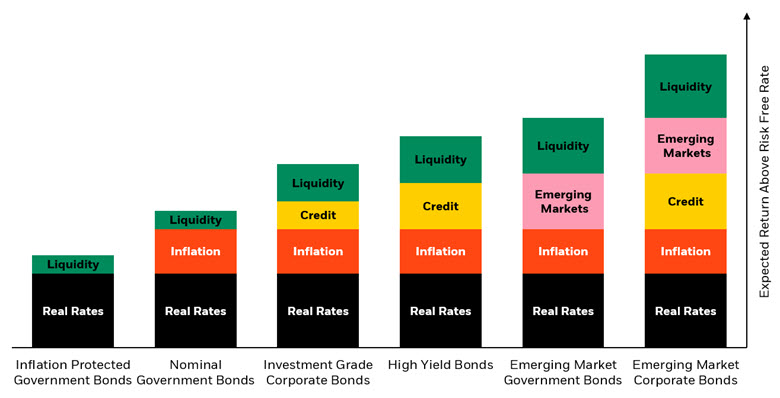

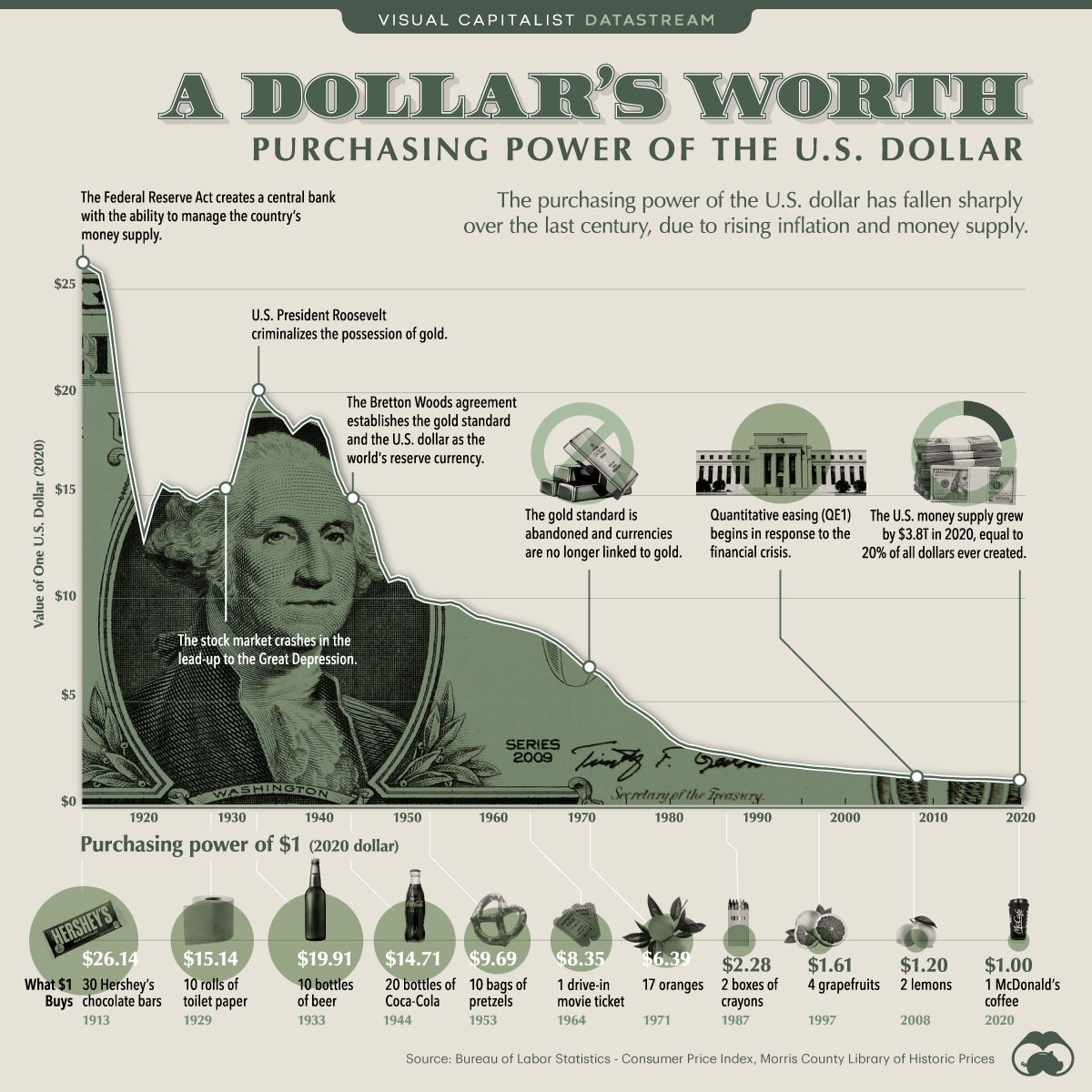

The heart of valuation in finance depends on the risk-free rate of a risk-free asset. The valuations of all stocks and bonds are dependent on the risk-free rate. The risk-free rate is a theoretical return an investor can realize for not taking on risk. Typically, the proxy for the risk-free rate is a U.S. Treasury bond. It is assumed that the U.S. cannot default on its debt, since the Federal Reserve and Treasury can print money (the benefits of being a world reserve currency). However, printing money is a default. When Nixon took the world off the gold standard in 1971 to pay for the Vietnam War, the U.S. inexplicitly defaulted on its debt. In addition to default risk, Treasury bonds are exposed to interest rate risk; the risk of price fluctuations as interest rates change. Given current market rates, the price of a Treasury bond issued today would be $100. However, interest rates could be higher tomorrow, causing the bond to lose value since investors now demand a higher return. An investor would buy the bond at a discount to ensure it yields the current market rate, so the price of the bond must fall. Lastly, U.S. Treasury bonds also carry inflation, liquidity (March 2020), and taxation risk. The notion of a risk-free rate and asset is flawed. That is until Bitcoin was conceived.

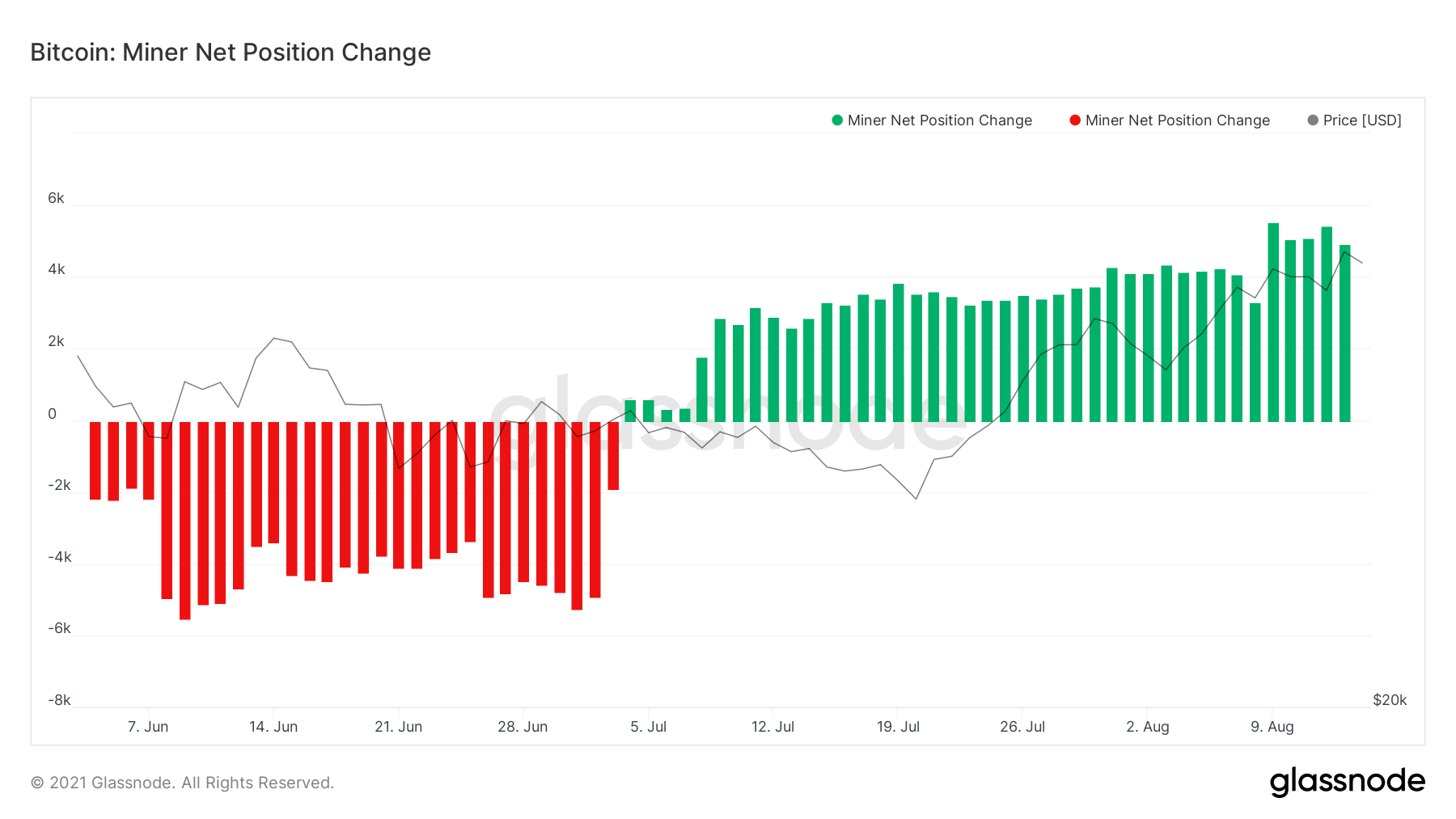

Bitcoin is the only risk-free asset. Bitcoin does not have default risk. Bitcoin is not a credit security. If in cold storage, Bitcoin is an asset; there is no chance of default through counterparty risk. Bitcoin does not have interest rate risk and taxation risk, since Bitcoin does not pay interest (Bitcoin credit products do). Bitcoin does not have inflation risk; there will only be 21 million coins. Yet, depending on the participant, Bitcoin does have liquidity risk. A large pension fund that manages $100 billion in assets, could have a hard time acquiring and selling Bitcoin due to low volume on exchanges. But given enough time, Bitcoin’s liquidity will rise.

Bitcoin is pristine, homogenous collateral; 1 Bitcoin is 1 Bitcoin. Given its pre-programmed inflation schedule, Bitcoin provides exceptional certainty. A hodler does not have to worry about the systemic risk that could expose them to counterparty risk. A hodler does not have to worry about its nation defaulting. A hodler can live a life independent from all risks.

Thank you for reading,

If you enjoyed this article, please share and check out pricedinbitcoin21.com and follow @pricedinbtc on Twitter. Priced in Bitcoin (the site) denominates various assets in Bitcoin, including precious metals such as Gold and Silver, public companies such as Apple and Tesla, ETFs (Exchange Traded Funds) such as Select Sector SPDR ETFs and iShares Treasury and Corporate Bond ETFs.

Bitcoin and Deflation

A Life in (Fiat) Recovery

Bitcoin is just math.

Bitcoin Basics

A layman's guide to understanding money supply.

Episodes of hyperinflation.

Warning: This might change your life

Bitcoin is the best treasury reserve asset.

May the best currency win.

The great currency debasement of the Roman Empire