How and why to think Macro

Published on 08/13/2021 12:07 AM

Written by @Handrev and originally published here: https://handrev-61206.medium.com/how-and-why-to-think-macro-464caf9a5690

The distinction is often made between macro and micro economics. The Austrian school points out that there should not be such a distinction because all of economics is made up of daily actions and decisions by individuals.

I like to think of this topic as if one is looking at the economic world through a telescope with different size zoom lenses.

Space and scope

One can “zoom in” and look at say, a single company. One can zoom in further and look inside said company at their balance sheet or income statement, then one can zoom in even further and analyse each item on those statements. On this same zoom level, you can move the telescope around and have a look at the company employees(one might even analyse a single employee for aspects such as education or character traits), assets, structures and a range of other variables. One can zoom out one level, move the scope around and look at the industry the company operates in, regulatory effects, competitors etc. One level above that, you could look at geographical aspects such as countries that are involved, general market trends, inflation, interest rates etc. The final zoom level would look at economic affairs on a global level; population growth, global technological trends, infrastructure, GDP and such.

Time

You could look at 10min trading candles and choose to make investment or trading decisions based on the data; 30min, 1hour, daily, weekly, monthly price movements etc. You could choose to zoom out further and take a yearly or 3 year view and make your decisions based on this. You could zoom out further and think very long term. Five, ten or twenty years into the future.

Somewhere in between all these zoom levels of space and time, at some stage, some economist decided that he or she will draw a line. Zooming in further than the line would be considered “Micro” and zooming out above the line would be considered “Macro”. Similarly, on the time zoom scale there is a line somewhere and if you are under the line you are “trading”, above the line you are “investing”.

Now let us move the lens to everyday life.

A bum would think very short term. Daily or hourly, “How do I get $1 in order to buy something to eat tonight?”. His life would probably also be confined to a small geographic area, a street corner with a nearby bridge and liquor shop.

The weekly wage worker would be one zoom level out from the bum. Spending his earnings, planning and thinking week to week. He would probably also move around town more, and generally take in and process more information and have a more complex thought structure than the bum.

Similarly, a monthly salary earner plans his budget month to month, has probably travelled interstate, has a better understanding of political, economic and world affairs than the previous two and might even have savings or investments demonstrating a longer term thought process(This is probably you).

If one zooms out to the maximum level for individuals you will get someone like Bill Gates. Influencing entire countries, owning companies and real estate all over the world and thinking very long term, similar to playing chess while thinking 15 moves in ahead. His geographical and time scope zoomed out to a grand scale.

Thinking macro necessitates thinking long term.

Doing one without the other is utterly useless. One might even say that thinking macro is thinking long term.

If you could calculate the world’s inflation rate, what could that knowledge benefit you over the next 2 days? On the other side of the spectrum, what benefit could a 30min stock price movement indication be to you over a 3 year period? Nothing.

As you increase your time scale you have to increase your scope area and vice versa. This is why it is so f-ing hard to think long term. But we all want to be more like Bill Gates than like the bum, don’t we?

A person needs to start the thought process of thinking “more” macro before real life actions can take effect. If you envision a maze from above, it is possible to navigate through it knowing which turn to take when, but if you just look straight ahead into a maze and take random turns as you go, you will be lost.

Day trading is a good example. Retail day traders are the beggars of the financial world: Consistently walking into the first turn of the maze and randomly picking what turn to take, without even acknowledging the maze exists. Making trading decisions by using information gathered within the last hour about the prices of real world goods. What they are seeing on the screen not only has sweet FA to do with what is happening in the real world, but even if it did, it would only make out a small fraction of what moves these prices.

When the aforementioned time and scope analogy is used, weekly or event traders will be a level above the day traders, then short and medium term investors and so on until you reach something akin to Buffet when he was in his prime. Investing globally with a 10 or 20 year return horizon. He could never have reached that level if he sat in front of a screen looking at hourly price movements, he had to zoom out first and use the information gathered from looking at the larger picture in order to make the correct decisions in real time.

What would be the optimum zoom level? As far out as possible. Remember that even if you die in 5 years, thinking longer term will still help you see the maze from above and enable you to make better decisions now. For this article’s sake, lets zoom out to between 5 and 50 years and look at some global trends. I will use a few examples to prime our brains into thinking “more” macro.

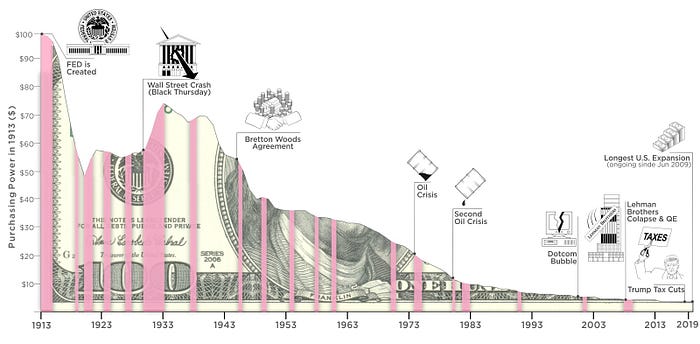

https://cdn.howmuch.net/articles/cover_rise-and-fall-dollar-4366.jpg

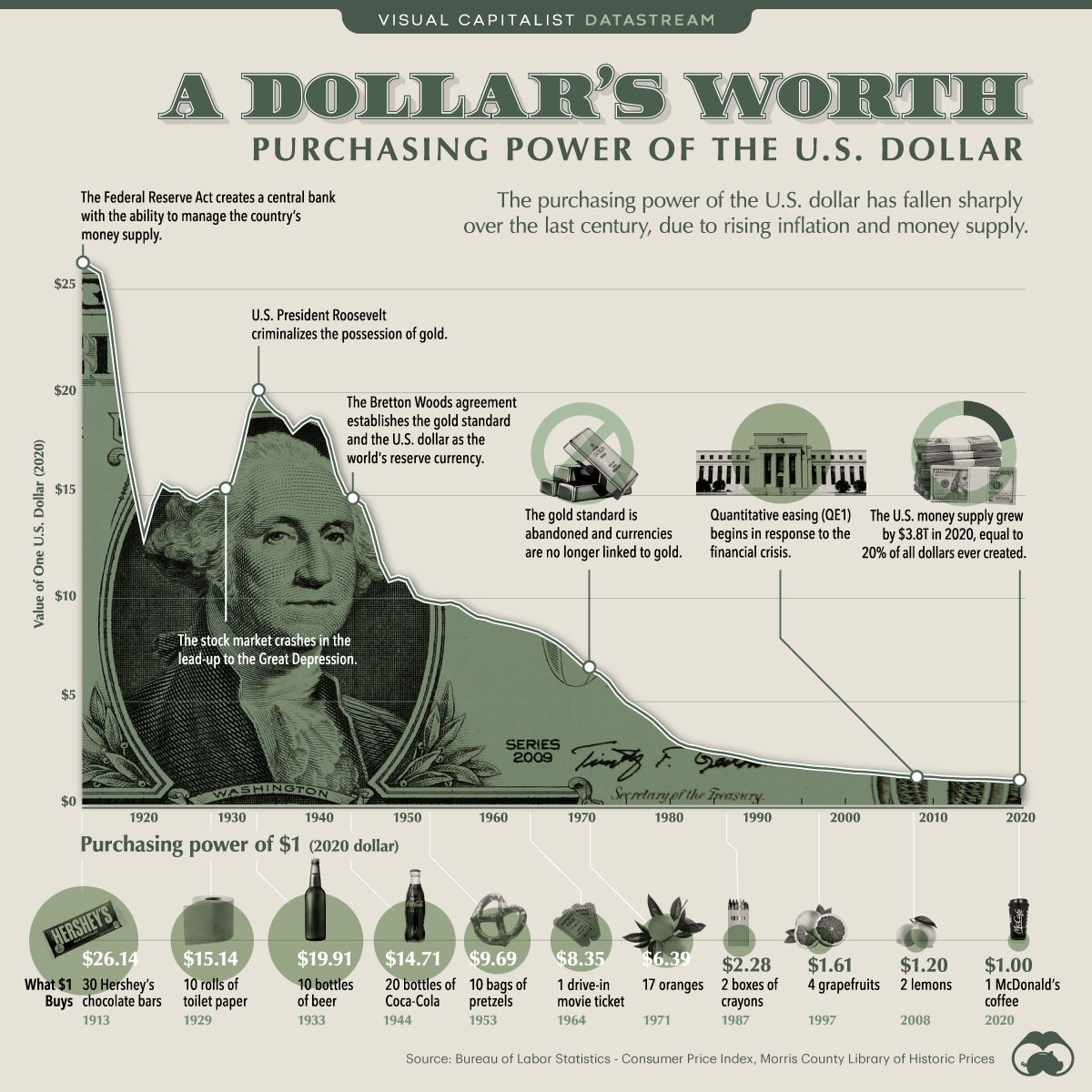

This is the Dollar losing its purchasing power. To be fair, the 1944 Bretton Woods agreement was the birth of today’s modern monetary system. We are looking at 80 years of currency value decline. On the very right hand side of this graph, today that Dollar is worth $0,40. In 15 years it will probably be worth $0,04. Keep in mind the Dollar has held its value particularly well compared to other world currencies who are much worse off than this. Assuming the future depreciation of currency as a constant, as most people do, how does this influence our decisions?

Note this is a semi-logarithmic chart

Does this look almost like the inverse of the above Dollar value chart to you? Of course these charts would correlate with one another, the S&P is denominated in Dollar and the value of the Dollar is decreasing at +-5% per year compounded. If the S&P simply maintains its relative value, it should rise at 5% per annum. Could it be that there has not been a whole lot of “value” added to the stock market over the years, but that the earnings and prices of companies have merely been propped up by newly minted Dollars? (“Adjusted for inflation” does not mean shit. Inflation is calculated using consumer prices, the basket and the weight of which are decided upon by government. Also, CPI does not include assets. More on that here.) In other words, more and more Dollars are flooding into the economy at escalating rates, those Dollars need to find a home. If the amount of net new listings on stock exchanges does not exceed the amount of new money in the economy directed at stocks, that means the price of existing stocks will rise, all other factors remaining the same.

Imagine in your mind’s eye the stock market as it were in 1950. A bunch of white guys in ugly suits, yelling at each other, with small pieces of paper in their hands. Every single stock was owned by someone. In order to sell your shares in a company, two requirements must be met: Someone else has to value the particular stock more than you value it and that person has to have the means to pay you for your shares. Why would someone value the shares you own more than you do? Because the knowledge they obtained, however macro or micro it might be, leads them to believe that someone else will want to buy those shares in the future for a higher value than they are paying you today. Creating and sustaining that belief is more important to a company’s share price than adding real value to the world.

In the mid twentieth century, dividends played a much more significant role in making investment decisions. Today, dividend payouts are so little that hardly anyone ever considers the dividend rate when making investment decisions. Why?

Receiving dividends, selling shares or taking out loans with your stock portfolio as security are the only means to realise your investment gains. Dividends and selling your shares are both heavily taxed by almost all governments around the world. This leaves us with loans. When you loan against a security and that security is put up as collateral, it cannot be sold. This causes less supply of that security on the market, which means price go up, which means dividend yield as % of the price goes down. Furthermore, companies now have an excuse not to pay dividends and rather reinvest profits to grow the company because as soon as the dividend is paid, 30% of the accumulated profit goes straight to the taxman. This means that between the company and the shareholders, 30% of the profit is now lost. Anyway, the point is more capital stays within companies and thus the stock market grows because money is not paid out to investors every year(which used to be the reason why people bought shares in the first place). This double whammy causes stock prices to rise without any value being created.

All the factors mentioned above have massive effects on long term stock prices, and we haven’t even mentioned factors like Income, Price Earnings, Economic Cycles, Unemployment, Politics, Interest rate adjustments, and on and on and on into oblivion. Can you now see how insignificant your 40 day moving average graph is?

Because we as society have been primed for 120 years to accept that our currency constantly depreciates(your great great grandparents were the last generation to live on the gold standard), everyone has accepted this as the norm. It is almost impossible to imagine a world where this is not the case.

What if you could store the reward for your labour(money), without taking the risk of investing, knowing your stored value will not depreciate over time? Just stop and think about this for a second.

What if your stored value increased instead of decreasing over time without investing in risk bearing assets?

In a world without monetary debasement, this should logically be the case. Let me explain. Technological advancements are making everything cheaper and easier to produce. Lets say in 1950 one man was able to produce 5 loafs of bread with one hour worth of work. Today, with modern technological advances(large dough mixers, automated bread shapers, etc), it is possible to produce say 50 loafs of bread with one man hour of work. That means that for the same amount of work a man now has 10 times more bread. If the currency in which the first man stored his value is not debased and keeps its value 100% compared to goods, this would mean that if he kept his value that was the equivalent of 5 loafs of bread in 1950 until today, that same amount of currency should be worth the equivalent of 50 loafs of bread, all other factors remaining the same.

Bitcoin is such a currency that can not be debased. Although it might feel like Bitcoin adoption is slow, zooming out you see that 11 years is nothing. One can hardly expect everyone in the world to start using a new currency overnight, but every day there are more and more people realising that storing their value for the future should be and can be risk free. Zoom out far enough and you realise that should Bitcoin adoption happen on a grand scale, what is happening now is exactly the way it will ascend.

First, just a couple of super geeks who bought a pizza used Bitcoin, then some early adopters, then came retail investors followed by institutions and now already after only a decade, governments.

Past, current and future price fluctuations are due to waves of new adopters entering the system. After every wave the price is exponentially higher as more people are vying to obtain their share of the limited Bitcoin in existence. As I am writing this there is no one who ever bought Bitcoin and held on to it for longer than 30 months who has not at least made 2x their initial investment. This is likely to remain true until Bitcoin adoption is complete. Thereafter the price will keep on rising incrementally as the amount of purchasable goods in the world increases compared to the limited supply of Bitcoin.

The argument from government economists that deflation is unworkable and will destroy the economy is total and utter garbage. If you disagree with this I urge you to read this thesis by Prof Jörg Guido Hülsmann or The Price of Tomorrow by Jeff Booth.

Buy Bitcoin now and hold on to it for dear life. The coming appreciation in value will dwarf every other investment out there.

If you read this to the end and understood everything, well done and thank you for sticking with me! Please follow me on twitter to see when I post a new article.

Bitcoin and Deflation

A Life in (Fiat) Recovery

Bitcoin is pristine, homogenous collateral

Bitcoin is just math.

Bitcoin Basics

A layman's guide to understanding money supply.

Episodes of hyperinflation.

Bitcoin is the best treasury reserve asset.

May the best currency win.

The great currency debasement of the Roman Empire