What Is Bitcoin?

Published on 08/10/2021 09:29 PM

This article was orginally published here: https://simplecryptoguide.com/what-is-bitcoin/, pricedinbitcoin21 only supports Bitcoin.

CHAPTERS

- Introduction To Bitcoin

- How Does Bitcoin Work?

- A History Of Bitcoin

- The Bitcoin Halving

- Common Bitcoin Misconceptions

- Bitcoin Scalability

- Participating In The Bitcoin Network

CHAPTER 1

Introduction To Bitcoin

WHAT IS BITCOIN?

Bitcoin is a digital form of cash. But unlike the fiat currencies you’re used to, there is no central bank controlling it. Instead, the financial system in Bitcoin is run by thousands of computers distributed around the world. Anyone can participate in the ecosystem by downloading open-source software.

Bitcoin was the first cryptocurrency, announced in 2008 (and launched in 2009). It provides users with the ability to send and receive digital money (bitcoins, with a lower-case b, or BTC). What makes it so attractive is that it can’t be censored, funds can’t be spent more than once, and transactions can be made at any time, from anywhere.

WHAT MAKES BITCOIN VALUABLE?

Bitcoin is decentralized, censorship-resistant, secure, and borderless.

This quality has made it appealing for use cases such as international remittance and payments where individuals don’t want to reveal their identities (as they would with a debit or credit card).

Many don’t spend their bitcoins, instead choosing to hold them for the long-term. Bitcoin has been nicknamed digital gold, due to a finite supply of coins available. Some investors view Bitcoin as a store of value. Because it’s scarce and difficult to produce, it has been likened to precious metals like gold or silver.

Holders believe that these traits – combined with global availability and high liquidity – make it an ideal medium for storing wealth in for long periods. They believe that Bitcoin’s value will continue to appreciate over time.

One of the biggest struggles for newcomers to crypto is grasping how and why a cryptocurrency like Bitcoin (BTC) can have value. The coin is digital, has no physical asset backing it up, and the concept of mining can be very confusing. In a sense, mining creates new bitcoins out of thin air. In practice, though, successful mining requires a very costly investment. But how can all of this make BTC valuable?

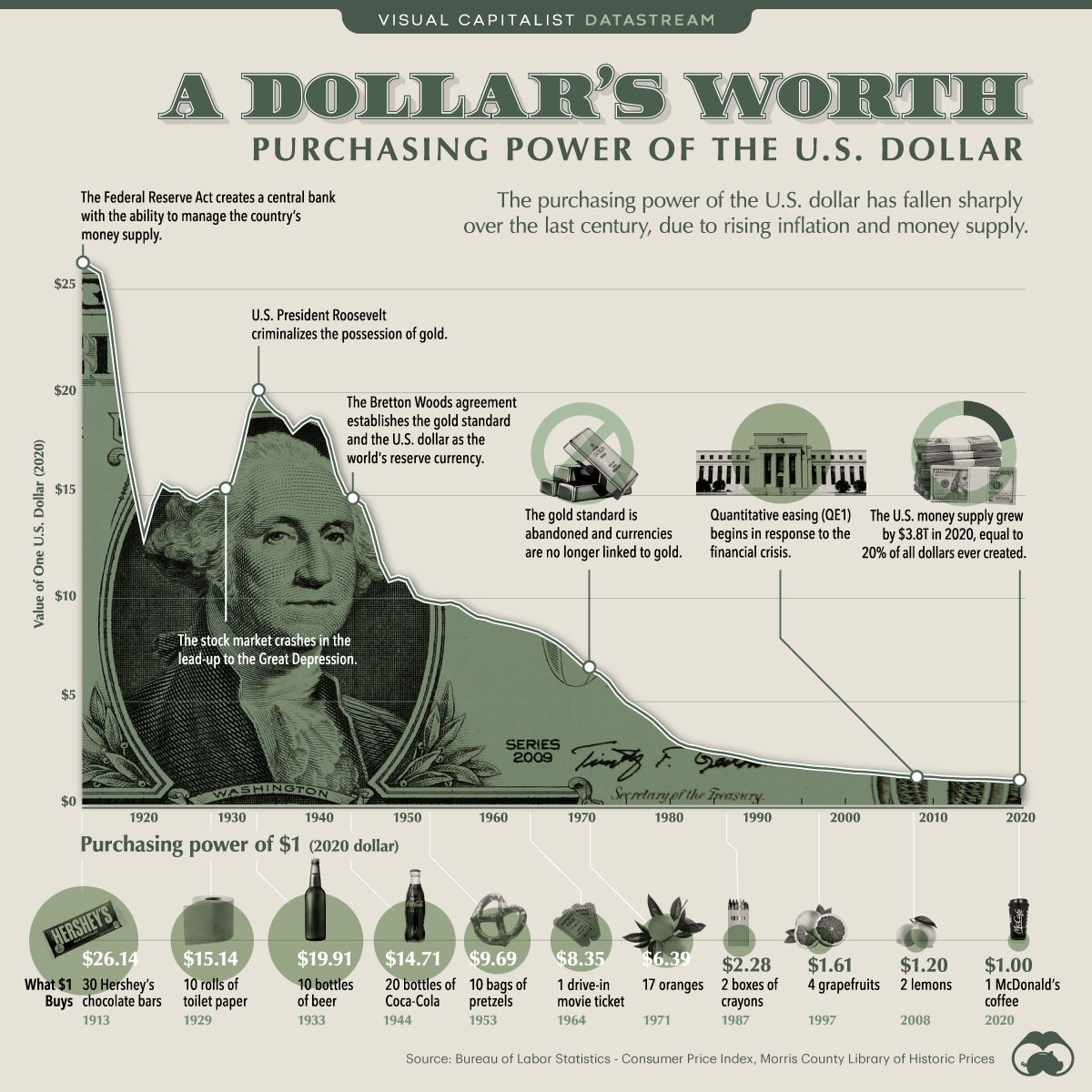

Think about the money we all use daily. There’s no longer gold or assets backing up our banknotes. Money that we borrow often exists only as numbers on a screen, thanks to fractional reserve banking. Governments and central banks like the Federal Reserve can create new money and increase its supply through economic mechanisms.

Although there are remarkable differences, BTC, as a digital form of money, shares some similarities with the fiat money we are all used to. So, let’s discuss first the value of fiat money before we dive into the cryptocurrency ecosystem.

WHY DOES MONEY HAVE VALUE?

In short, what gives money value is trust. Essentially, money is a tool used to exchange value. Any object could be used as money, as long as the local community accepts it as payment for goods and services. In the early days of human civilization, we had all kinds of objects being used as money – from rocks to seashells.

WHAT IS FIAT MONEY?

Fiat money is the one issued and officialized by a government. Today, our society exchanges value through the use of paper notes, coins, and digital numbers on our bank accounts (which also define how much credit or debt we have).

In the past, people could go to the bank to exchange their paper money for gold or other precious metals. Back then, this mechanism ensured that currencies like the U.S. dollar had their value tied to an equivalent amount in gold. However, the gold standard was abandoned by the majority of nations and is no longer the basis of our monetary systems.

After removing a currency’s ties to gold, we now use fiat money without any backing. This uncoupling gave governments and central banks more freedom to adopt monetary policies and affect the money supply. Some of the main characteristics of fiat are:

-

It’s issued by a central authority or government.

-

It has no inherent value. It’s not backed by gold nor any other commodity.

-

It has an unlimited potential supply.

WHY DOES FIAT HAVE VALUE?

With the removal of the gold standard, we seemingly have a currency without value. Money does, however, still pay for our food, bills, rent, and other items. As we discussed, money derives its value from collective trust. Therefore, a government needs to firmly back and successfully manage a fiat currency to succeed and maintain a high level of trust. It’s easy to see how this breaks down when faith in a government or central bank is lost due to hyperinflation and inefficient monetary policies, as seen in Venezuela and Zimbabwe.

WHAT IS INTRINSIC VALUE?

A lot of the discussion regarding Bitcoin’s worth is whether it has any intrinsic value. But what does this mean? If we look at a commodity like oil, it has intrinsic value in producing energy, plastics, and other materials.

Stocks also have intrinsic value, as they represent equity in a company producing goods or services. In fact, many investors perform fundamental analysis in an attempt to calculate an asset’s intrinsic value. On the other hand, fiat money has no intrinsic value because it’s just a piece of paper. As we’ve seen, its value derives from trust.

The traditional financial system has many investment options that carry intrinsic value, from commodities to stocks. Forex markets are an exception as they deal with fiat currencies, and traders often profit from short or mid-term exchange rate swings. But what about Bitcoin?

BITCOIN’S VALUE IN UTILITY

One of the major benefits of Bitcoin is its ability to quickly transfer large amounts of value worldwide without the need for intermediaries. While it can be relatively expensive to send a small amount of BTC due to fees, it’s also possible to send millions of dollars cheaply. Here, you can see a Bitcoin transaction worth around $45,000,000 (USD) sent with a fee of just under $50 (as of June 2021).

While Bitcoin isn’t the only network that makes this possible, it’s still the largest, safest, and most popular. The Lightning Network also makes small transactions possible as a layer two application. But regardless of the amount, being able to make borderless transactions is certainly valuable.

BITCOIN’S VALUE IN DECENTRALIZATION

Decentralization is one of the key features of cryptocurrencies. By cutting out central authorities, blockchains give more power and freedom to the community of users. Anyone can help improve the Bitcoin network due to its open-source nature.

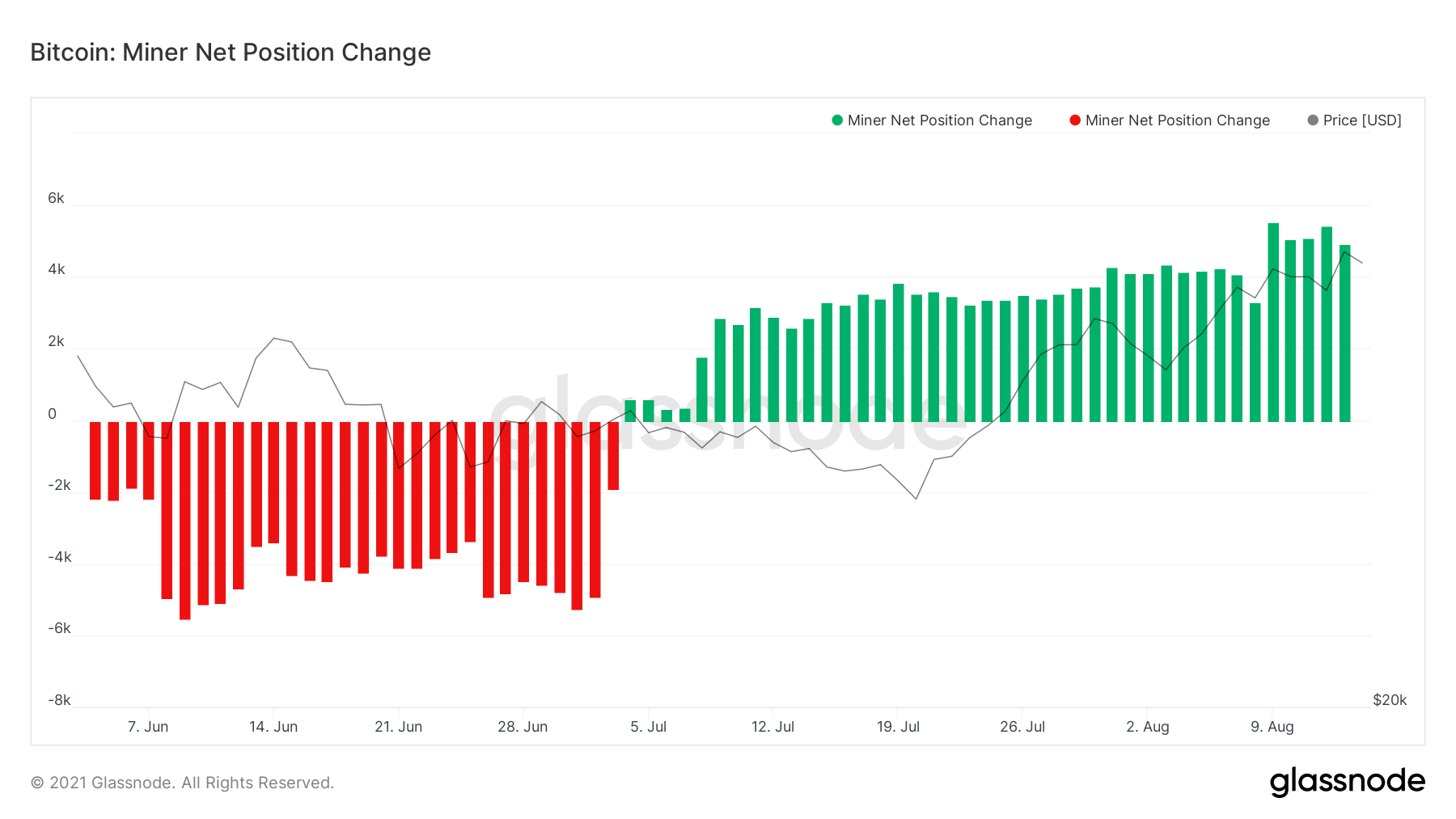

Even the cryptocurrency’s monetary policy works in a decentralized manner. The work of miners, for example, involves verifying and validating transactions, but it also ensures that new bitcoins are added into the system at a predictable, steady rate.

Bitcoin’s decentralization gives it a very robust and secure system. No single node on the network can make decisions on everyone’s behalf. Transaction validation and protocol updates all need to have group consensus, protecting Bitcoin from mismanagement and abuse.

BITCOIN’S VALUE IN DISTRIBUTION

By allowing as many people as possible to participate, the Bitcoin network improves its overall security. The more nodes connected to Bitcoin’s distributed network, the more value it gets. In distributing the ledger of transactions across different users, there’s no need to rely on a single source of truth.

Without distribution, we can have multiple versions of the truth that are difficult to verify. Think about a document sent via email that a team is working on. As the team sends the document among themselves, they create different versions with different states that can be difficult to track.

Also, a centralized database is more susceptible to cyber-attacks and outages than a distributed one. It’s not uncommon to have issues using a credit card because of a server issue. A cloud-based system like the one of Bitcoin is maintained by thousands of users around the world, making it much more efficient and secure.

BITCOIN’S VALUE IN SYSTEMS OF TRUST

Bitcoin’s decentralization is a huge network benefit, but it still needs some safeguarding. Getting users to cooperate on any large, decentralized network is always a challenge. To solve this problem, known as the Byzantine General’s Problem, Satoshi Nakamoto implemented a Proof of Work consensus mechanism that rewards positive behavior.

Trust is an essential part of any valuable item or commodity. Losing trust in a central bank is disastrous for a nation’s currency. Likewise, to use international money transfers, we have to trust the financial institutions involved. There is more inbuilt trust in Bitcoin’s operations than other systems and assets we use daily.

However, Bitcoin users don’t need to trust each other. They only need to trust Bitcoin’s technology, which has proven to be very reliable and secure and the source code is open for anyone to see. Proof of Work is a transparent mechanism that anyone can verify and check themselves. It’s easy to see the value here in generating consensus that is almost always error-free.

BITCOIN’S VALUE IN SCARCITY

Inbuilt within Bitcoin’s framework is a limited supply of 21,000,000 BTC. No more will be available once Bitcoin miners mine the last coin around 2140. While traditional commodities like gold, silver, and oil are limited, we find new reserves every year. These discoveries make it difficult to calculate their exact scarcity.

Once we have mined all BTC, Bitcoin should, in theory, be deflationary. As users lose or burn coins, the supply will decrease and likely cause an increase in price. For this reason, holders see a lot of value in Bitcoin’s scarcity.

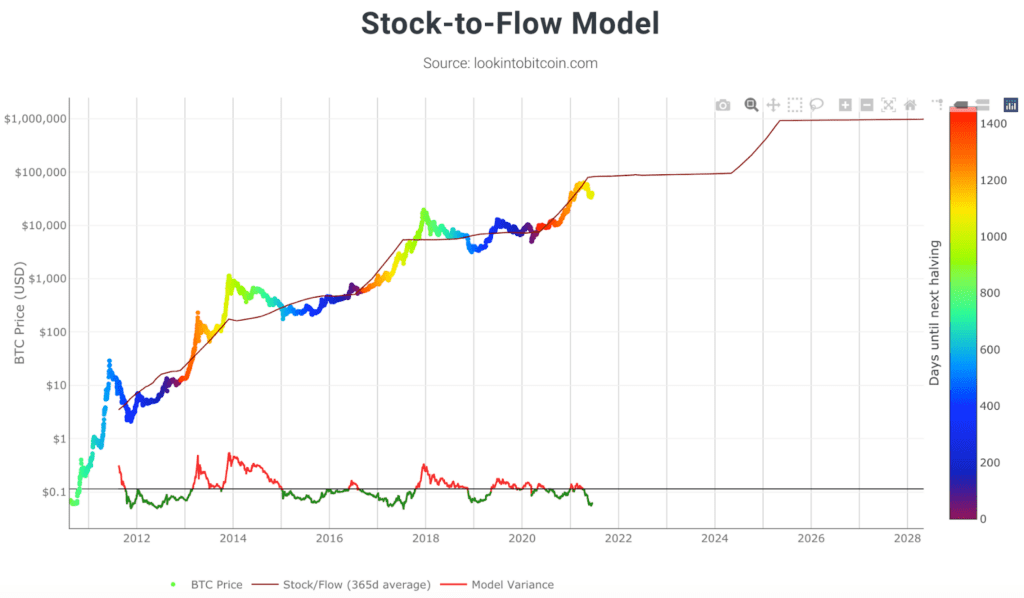

Bitcoin’s scarcity has also led to the popular Stock to Flow model. The model attempts to predict BTC’s future value based upon Bitcoin mining per year and the overall stock. When back-tested, it quite accurately models the price curve that we have seen so far. According to this model, the main driving force in Bitcoin’s price is its scarcity. By having a possible relationship between price and scarcity, holders find value in using Bitcoin as a store of value. We’ll dive further into this concept at the end of the article.

BITCOIN’S VALUE IN SECURITY

In terms of keeping your invested funds safe, there aren’t many other options that provide as much security as Bitcoin. If you follow the best practices, then your funds are incredibly secure. In developed countries, you can easily take for granted the security offered by banks. But for many people, financial institutions cannot provide them the protection they need, and holding large amounts of cash can be very risky.

Malicious attacks to the Bitcoin network require owning more than 51% of current mining power, making coordination on this scale almost impossible. The probability of a successful attack on Bitcoin is extremely low, and even if it happens, it won’t last long.

The only real threats to the storage of your BTC are:

-

Fraud and phishing attacks

-

Losing your private key

-

Storing your BTC in a compromised custodial wallet where you don’t own the private key

By following best practices to make sure the above doesn’t happen, you should have a level of security that exceeds even your bank. The best part is that you don’t even have to pay to keep your crypto safe. And unlike banks, there are no daily or monthly limits. Bitcoin allows you to have full control over your money.

BITCOIN AS A STORE OF VALUE

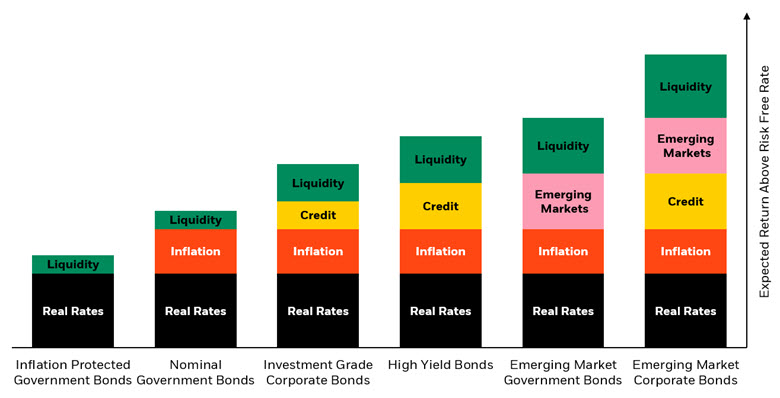

Most of the characteristics already described also make Bitcoin a good fit as a store of value. Precious metals, U.S. dollars, and government bonds are more traditional options, but Bitcoin is gaining a reputation as a modern alternative and digital gold. For something to be a good store of value, it needs:

-

Durability: So long as there are still computers maintaining the network, Bitcoin is 100% durable. BTC cannot be destroyed like physical cash and is, in fact, more durable than fiat currencies and precious metals.

-

Portability: As a digital currency, Bitcoin is incredibly portable. All you need is an Internet connection and your private keys to access your BTC holdings from anywhere.

-

Divisibility: Each BTC is divisible into 100,000,000 satoshis, allowing users to make transactions of all sizes.

-

Fungibility: Each BTC or satoshi is interchangeable with another. This aspect allows the cryptocurrency to be used as an exchange of value with others globally.

-

Scarcity: There will only ever be 21,000,000 BTC in existence, and millions are already lost forever. Bitcoin’s supply is much more limited than inflationary fiat currencies, where the supply increases over time.

-

Acceptability: There’s been widespread adoption of BTC as a payment method for individuals and companies, and the blockchain industry just continues to grow every day.

There is, unfortunately, no single and neat answer as to why Bitcoin has value. The cryptocurrency has the key aspects of many assets with worth, like precious metals and fiat, but doesn’t fit into an easily identifiable box. It acts like money without government backing and has scarcity like a commodity even though it’s digital.

But, ultimately, Bitcoin runs on a very secure network and the cryptocurrency has a considerable amount of value placed on it by its community, investors, and traders.

If you’d like to view Bitcoins performance compared to various other assets over the past few years including precious metals such as Gold and Silver, public companies such as Apple and Tesla, ETFs (Exchange Traded Funds) such as Select Sector SPDR ETFs and iShares Treasury and Corporate Bond ETFs you can do so at PricedInBitcoin21.

CHAPTER 2

How Does Bitcoin Work?

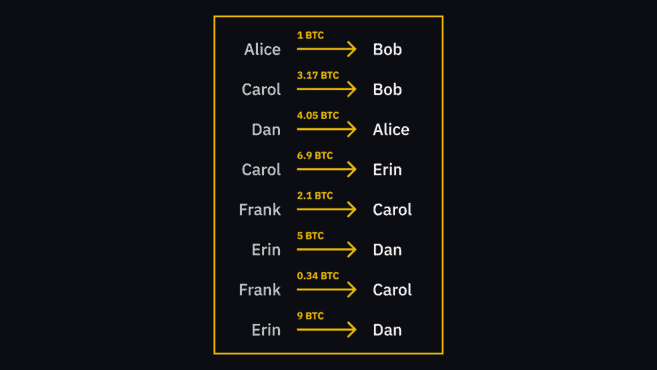

When Alice makes a transaction to Bob, she’s not sending funds in the way you’d expect. It’s not like the digital equivalent of handing him a dollar bill. It’s more like her writing on a sheet of paper (that everyone can see) that she’s giving one dollar to Bob. When Bob goes to send those same funds to Carol, she can see that Bob has them by looking at the sheet.But, ultimately, Bitcoin runs on a very secure network and the cryptocurrency has a considerable amount of value placed on it by its community, investors, and traders.

The sheet is a particular kind of database called a blockchain. Network participants all have an identical copy of this stored on their devices. The participants connect with each other to synchronize new information.

When a user makes a payment, they broadcast it directly to the peer-to-peer network – there isn’t a centralized bank or institution to process transfers. In order to add new information, the Bitcoin blockchain uses a special mechanism called mining. It is through this process that new blocks of transactions are recorded in the blockchain.

WHAT IS THE BLOCKCHAIN?

The blockchain is a ledger that is append-only: that is to say, data can only be added to it. Once information is added, it is extremely difficult to modify or delete it. The blockchain enforces this by including a pointer to the previous block in every subsequent block. The pointer is actually a hash of the previous block. Hashing involves passing data through a one-way function to produce a unique “fingerprint” of the input. If the input is modified even slightly, the fingerprint will look completely different. Since we chain the blocks along, there is no way for someone to edit an old entry without invalidating the blocks that follow. Such a structure is one of the components making the blockchain secure.

For more information on blockchains, see What is Blockchain?

IS BITCOIN LEGAL?

Bitcoin is perfectly legal in most countries. There are a handful of exceptions, though – be sure to read up on the laws of your jurisdiction before investing in cryptocurrency.

In countries where it’s legal, government entities take varying approaches to it where taxation and compliance are concerned. The regulatory landscape is still highly underdeveloped overall and will likely change considerably in the coming years.

WHAT IF I LOSE MY BITCOINS?

Because there’s no bank involved, you’re responsible for keeping your coins secure. Some prefer to store them on exchanges, while others take custody with a variety of wallets. If you use a wallet, it’s crucial that you write down your seed phrase so that you can restore it.

CAN I REVERT BITCOIN TRANSACTIONS?

Once data is added to the blockchain, it’s not easy to remove it (in practice, it’s virtually impossible). This means that when you make a transaction, it can’t be undone. You should always double- and triple-check that you’re sending your funds to the right address.

HOW CAN I STORE MY BITCOIN?

There are many options to store coins, each with their own strengths and weaknesses.

STORING YOUR BITCOIN ON AN EXCHANGE

A custodial solution refers to storage where the user doesn’t actually hold the coins themselves but trusts a third party to do so. To make transactions, they would log in to the third party’s platform. Exchanges like Binance often use this model as it’s vastly more efficient for trades.

Storing your coins on Binance allows you to easily access them for the purposes of trading or lending.

STORING YOUR COINS IN A BITCOIN WALLET

Non-custodial solutions are the opposite – they put the user in control of their funds. To store funds with such a solution, you use something called a wallet. A wallet doesn’t hold your coins directly – rather, it holds cryptographic keys that unlock them on the blockchain. You have two main options on this front:

HOT WALLETS

A hot wallet is software that connects in some way to the Internet. Generally, it will take the form of a mobile or desktop application that allows you to easily send and receive coins. An easy to use example of a mobile wallet with a lot of supported coins is Trust Wallet. Because they’re online, hot wallets are generally more convenient for payments, but they’re also more vulnerable to attack.

COLD WALLETS

Cryptocurrency wallets that are not exposed to the Internet are known as cold wallets. They’re less prone to attack because there is no online attack vector, but they consequently tend to provide a clunkier user experience. Examples include hardware wallets or paper wallets. Most widespead examples of this being the Ledger Nano and the Trezor.

For a more in-depth breakdown of wallet types, be sure to check out Crypto Wallets.

CHAPTER 3

A History Of Bitcoin

WHO CREATED BITCOIN?

Nobody knows! Bitcoin’s creator used the pseudonym Satoshi Nakamoto, but we don’t know anything about their identity. Satoshi could be one person or a group of developers anywhere in the world. The name is of Japanese origin, but Satoshi’s mastery of English has led many to believe that he/she/they originate from an English-speaking country.

Satoshi published the Bitcoin white paper as well as the software. However, the mysterious creator disappeared in 2010.

DID SATOSHI INVENT BLOCKCHAIN TECHNOLOGY?

Bitcoin actually combines a number of existing technologies that had been around for some time. This concept of a chain of blocks wasn’t born with Bitcoin. The use of unalterable data structures like this can be traced back to the early 90s when Stuart Haber and W. Scott Stornetta proposed a system for timestamping documents. Much like the blockchains of today, it relied on cryptographic techniques to secure data and to prevent it from being tampered with.

Interestingly, at no point does Satoshi’s white paper make use of the term “blockchain.”

DIGITAL CASH BEFORE BITCOIN

Bitcoin wasn’t the first attempt at digital cash, but it is certainly the most successful. Previous schemes paved the way for Satoshi’s invention:

DIGICASH

DigiCash was a company founded by cryptographer and computer scientist David Chaum in the late 1980s. It was introduced as a privacy-oriented solution for online transactions, based on a paper authored by Chaum.

The DigiCash model was a centralized system, but it was nonetheless an interesting experiment. The company later went bankrupt, which Chaum believes was due to its introduction before e-commerce had truly taken off.

B-MONEY

B-money was initially described in a proposal by computer engineer Wei Dai, published in the 1990s. It was cited in the Bitcoin white paper, and it’s not hard to see why.

B-money proposed a Proof of Work system (used in Bitcoin mining) and the use of a distributed database where users sign transactions. A second version of b-money also described an idea similar to staking, which is used in other cryptocurrencies today.

Ultimately, b-money never took off, as it didn’t make it past the draft stage. That said, Bitcoin clearly takes inspiration from the concepts presented by Dai.

BIT GOLD

Such is the resemblance between Bit Gold and Bitcoin that some believe that its creator, computer scientist Nick Szabo, is Satoshi Nakamoto. At its core, Bit Gold consists of a ledger that records strings of data originating from a Proof of Work operation.

Like b-money, it was never further developed. Bit Gold’s similarities to Bitcoin have, however, cemented its place as the “precursor to Bitcoin.”

HOW ARE NEW BITCOINS CREATED?

Bitcoin has a finite supply, but not all units are in circulation yet. The only way to create new coins is through a process called mining – the special mechanism for adding data to the blockchain.

HOW MANY BITCOINS ARE THERE?

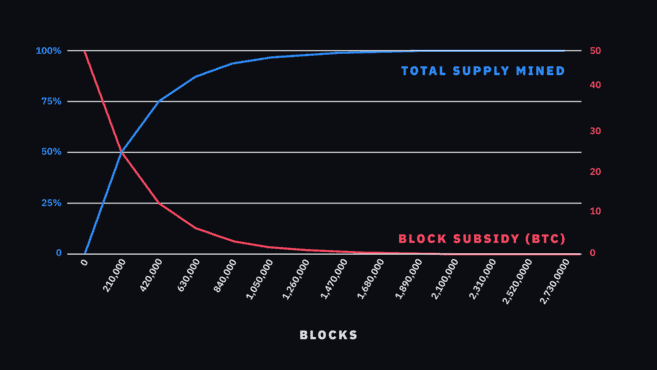

The protocol fixes Bitcoin’s max supply at twenty-one million coins. As of 2020, just under 90% of these have been generated, but it will take over one-hundred years to produce the remaining ones. This is due to periodic events known as halvings, which gradually reduce the mining reward.

HOW DOES BITCOIN MINING WORK?

By mining, participants add blocks to the blockchain. To do so, they must dedicate computing power to solving a cryptographic puzzle. As an incentive, there is a reward available to whoever proposes a valid block.

It’s expensive to generate a block, but cheap to check if it’s valid. If someone tries to cheat with an invalid block, the network immediately rejects it, and the miner will be unable to recoup the mining costs.

The reward – often labeled the block reward – is made up of two components: fees attached to the transactions and the block subsidy. The block subsidy is the only source of “fresh” bitcoins. With every block mined, it adds a set amount of coins to the total supply.

HOW LONG DOES IT TAKE TO MINE A BLOCK?

The protocol adjusts the difficulty of mining so that it takes approximately ten minutes to find a new block. Blocks aren’t always found exactly ten minutes after the previous one – the time taken merely fluctuates around this target.

CHAPTER 4

The Bitcoin Halving

WHAT IS THE BITCOIN HALVING?

A Bitcoin halving (also called a Bitcoin halvening) is simply an event that reduces the block reward. Once a halving occurs, the reward given to miners for validating new blocks is divided by two (they only receive half of what they used to). However, there is no impact on transaction fees.

HOW DOES THE BITCOIN HALVING WORK?

When Bitcoin launched, miners would be awarded 50 BTC for each valid block they found.

The first halving took place on November 28th, 2012. At that point, the protocol reduced the block subsidy from 50 BTC to 25 BTC. The second halving occurred on July 9th, 2016 (25 BTC to 12.5 BTC). The last one took take place on May 11th, 2020, bringing the block subsidy down to 6.25 BTC.

You might notice a certain pattern here. Give or take a handful of months, a new halving seems to occur every four years. That’s by design, but the protocol does not set specific dates on which a halving takes place. Instead, it goes by block height – every 210,000 blocks, a halving occurs. So, we can expect it to take about 2,100,000 minutes for the subsidy to halve (remember, a block takes ~10 minutes to mine).

In the above chart, we can see the decrease in the block subsidy over time and its relationship with the total supply. At first, it may seem that the rewards have dropped to zero and that the max supply is already in circulation. But this is not the case. The curves trend incredibly close, but we expect the subsidy to reach zero around the year 2140.

WHY DOES THE BITCOIN HALVING HAPPEN?

It’s one of Bitcoin’s main selling points, but Satoshi Nakamoto never fully explained his reasoning for capping the supply at twenty-one million units. Some speculate that it’s merely a product of starting with a block subsidy of 50 BTC, which is halved every 210,000 blocks.

Having a finite supply means that the currency is not prone to debasement in the long run. It stands in stark contrast to fiat money, which loses purchasing power over time as new units enter into circulation.

It makes sense that there are limits on how fast participants can mine coins. After all, 50% were generated by block 210,000 (i.e., by 2012). If the subsidy remained the same, all units would have been mined by 2016.

With the halving mechanism, there is an incentive to mine for 100+ years. This gives the system more than enough time to attract users so that a fee market can develop.

WHAT IMPACT DOES THE BITCOIN HALVING HAVE?

Those that are most impacted by halvings are miners. It makes sense, as the block subsidy makes up a significant part of their revenue. When it is halved, they only receive half of what they once did. The reward also consists of transaction fees, but to date, these have only made up a fraction of the block reward.

Halvings could, therefore, make it unprofitable for some participants to continue mining. What this means for the wider industry is unknown. A reduction in block rewards might lead to further centralization in mining pools, or it could simply promote more efficient mining practices.

If Bitcoin continues to rely on a Proof of Work algorithm, fees would need to rise to keep mining profitable. This scenario is entirely possible, as blocks can only hold so many transactions. If there are a lot of pending transactions, those with higher fees will be included first.

Historically, a sharp rise in Bitcoin price has followed a halving. Of course, there isn’t much data available as we’ve only seen two so far. Many attribute the price movement to an appreciation of Bitcoin’s scarcity by the market, a realization triggered by the halving. Proponents of this theory believe that value will once again skyrocket following the event in May 2020.

Others disagree with this logic, arguing that the market has already factored the halving in (see Efficient Market Hypothesis). It’s not like the event comes as a surprise – participants have known for over a decade that the reward would be reduced in May 2020. Another point often made is that the industry was extremely underdeveloped during the first two halvings. Nowadays, it has a higher profile, offers sophisticated trading tools, and is more accommodating to a broader investor pool.

WHEN IS THE NEXT BITCOIN HALVING?

The next halving is expected to take place in 2024, when the reward will drop to 3.125 BTC. Keep an eye on the countdown with Nicehash’s Bitcoin Halving Countdown.

CHAPTER 5

Common Bitcoin Misconceptions

IS BITCOIN ANONYMOUS?

Not really. Bitcoin might seem anonymous initially, but this isn’t correct. The Bitcoin blockchain is public and anyone can see the transactions. Your identity isn’t tied to your wallet addresses on the blockchain, but an observer with the right resources could potentially link the two together. It’s more accurate to describe Bitcoin as pseudonymous. Bitcoin addresses are viewable to everybody, but the names of their owners are not.

That said, the system is relatively private, and there are methods to make it even harder for observers to figure out what you’re doing with your bitcoins. Freely available technologies can create plausible deniability to “break the link” between addresses. What’s more, future upgrades could massively boost privacy

IS BITCOIN A SCAM?

No. Just like fiat money, Bitcoin may also be used for illegal activities. But, this doesn’t make Bitcoin a scam in and of itself.

Bitcoin is a digital currency that isn’t controlled by anyone. Detractors have branded it a pyramid scheme, but it doesn’t fit the definition. As digital money, it functions just as well at $20 per coin as it does at $20,000 per coin. It’s over a decade old, and the technology has proven to be very secure and reliable.

Unfortunately, Bitcoin is used in many scams that you should be aware of. These might include phishing and other social engineering schemes, such as fake giveaways and airdrops. As a general rule: if something sounds too good to be true, it’s probably a scam. Never give your private keys or seed phrase to anyone, and be cautious of schemes that offer to multiply your money with little risk on your behalf. If you send your coins to a scammer or to a fake giveaway, they will be lost forever.

IS BITCOIN A BUBBLE?

Throughout the many parabolic rises in Bitcoin price, it was common to see people referring to it as a speculative bubble. Many economists have compared Bitcoin to periods like the Tulip Mania or the dot-com boom.

Due to Bitcoin’s unique nature as a decentralized digital commodity, its price is entirely dictated by speculation in the free market. So, while there are many factors driving the Bitcoin price, they ultimately affect market supply and demand. And since Bitcoin is scarce and follows a strict issuance schedule, it’s thought that long-term demand will exceed supply.

The cryptocurrency markets are also relatively small when compared to traditional markets. This means that Bitcoin and other crypto assets tend to be more volatile, and it’s quite common to see short-term market imbalances between supply and demand.

In other words, Bitcoin can be a volatile asset at times. But volatility is part of the financial markets, especially ones with relatively lower volume and liquidity.

DOES BITCOIN USE ENCRYPTION?

No. This is a common misconception, but Bitcoin’s blockchain doesn’t use encryption. Every peer on the network needs to be able to read transactions to ensure that they’re valid. Instead, it uses digital signatures and hash functions. While some digital signature algorithms do use encryption, that’s not the case for Bitcoin.

It’s worth noting, though, that many applications and crypto wallets make use of encryption to protect users’ wallets with passwords. Still, these encryption methods have nothing to do with the blockchain – they’re just incorporated into other technologies that tap into it.

CHAPTER 6

Bitcoin Scalability

WHAT IS SCALABILITY?

Scalability is a measure of a system’s ability to grow to accommodate increasing demand. If you host a website that’s overrun with requests, you might scale it by adding more servers. If you want to run more intensive applications on your computer, you could upgrade its components.

In the context of cryptocurrencies, we use the term to describe the ease of upgrading a blockchain so it can process a higher number of transactions.

WHY DOES BITCOIN NEED TO SCALE?

To function in day-to-day payments, Bitcoin must be fast. As it stands, it has a relatively low throughput, meaning that a limited amount of transactions can be processed per block.

As you know from the previous chapter, miners receive transaction fees as part of the block reward. Users attach these to their transactions to incentivize miners to add their transactions to the blockchain.

Miners seek to make a return on their investment into hardware and electricity, so they prioritize transactions with higher fees. If there are a lot of transactions in the network’s “waiting room” (called the mempool), fees can rise significantly as users bid to have theirs included. At its worst, the average fee was upwards of $50.

HOW MANY TRANSACTIONS CAN BITCOIN PROCESS?

Based on the average number of transactions per block, Bitcoin can manage approximately five transactions per second at the moment. It’s much lower than that of centralized payment solutions, but this is one of the costs of a decentralized currency.

Because it’s not managed by a data center that a single entity can upgrade at will, Bitcoin must limit the size of its blocks. A new block size that allows 10,000 transactions per second could be integrated, but it would harm the network’s decentralization. Remember that full nodes need to download new information roughly every ten minutes. If it becomes too burdensome for them to do so, they’ll likely go offline.

If the protocol is to be used to payments, Bitcoin enthusiasts believe that effective scaling needs to be achieved in different ways.

WHAT IS THE LIGHTNING NETWORK?

The Lightning Network is a proposed scalability solution for Bitcoin. We call it a layer two solution because it moves transactions away from the blockchain. Instead of recording all transactions on the base layer, they’re handled by another protocol built on top of it.

The Lightning Network allows users to send funds near-instantly and for free. There are no constraints on throughput (provided users have the capacity to send and receive). To use the Bitcoin Lightning Network, two participants lock up some of their coins in a special address. The address has a unique property – it only releases the bitcoins if both parties agree.

From there, the parties keep a private ledger that can reallocate balances without announcing it to the main chain. They only publish a transaction to the blockchain when they’re done. The protocol then updates their balances accordingly. Note that they don’t need to trust each other, either. If one tries to cheat, the protocol will detect it and punish them.

In total, a payment channel like this one only requires two on-chain transactions from the user – one to fund their address and one to later dispense the coins. This means that thousands of transfers can be made in the meantime. With further development and optimization, the technology could become a critical component for large blockchain systems.

WHAT ARE FORKS?

Since Bitcoin is open-source, anyone can modify the software. You could add new rules or remove old ones to suit different needs. But not all changes are created equal: some updates will make your node incompatible with the network, while others will be backward-compatible.

SOFT FORKS

A soft fork is a change to the rules that allows updated nodes to interact with old ones. Let’s take block size as an example. Suppose that we have a block size of 2MB and that half of the network implements a change – from now on, all blocks must not exceed 1MB. They would reject anything bigger.

Older nodes can still receive these blocks or propagate their own. That means that all nodes remain part of the same network, no matter which version they run.

Bitcoin’s Segregated Witness (or SegWit) is an example of a soft fork. Using a clever technique, it introduced a new format for blocks and transactions. Old nodes continue to receive blocks, but they don’t validate the new transaction type.

HARD FORKS

A hard fork is messier. Suppose now that half of the network wants to increase the block size from 2MB to 3MB. If you try to send a 3MB block to older nodes, the nodes reject it as the rules clearly state that 2MB is the maximum they can accept. Because the two networks are no longer compatible, the blockchain splits into two.

Now there are two different protocols, each with a different currency. All the balances on the old one are cloned, meaning that if you had 20 BTC on the original chain, you have 20 NewBTC on the new one.

In 2017, Bitcoin went through a controversial hard fork in a scenario similar to the above. A minority of participants wanted to increase the block size to ensure more throughput and cheaper transaction fees. Others believed this to be a poor scaling strategy. Eventually, the hard fork gave birth to Bitcoin Cash (BCH), which split from the Bitcoin network and now has an independent community and roadmap.

CHAPTER 7

Participating In The Bitcoin Network

WHAT IS A BITCOIN NODE?

“Bitcoin node” is a term used to describe a program that interacts with the Bitcoin network in some way. It can be anything from a mobile phone operating a Bitcoin wallet to a dedicated computer that stores a full copy of the blockchain.

There are several types of nodes, each performing specific functions. All of them act as a communication point to the network. Within the system, they transmit information about transactions and blocks.

HOW DOES A BITCOIN NODE WORK?

FULL NODES

A full node validates transactions and blocks if they meet certain requirements (i.e., follow the rules). Most full nodes run the Bitcoin Core software, which is the reference implementation of the Bitcoin protocol.

Bitcoin Core was the program released by Satoshi Nakamoto in 2009 – it was simply named Bitcoin at the time, but was later renamed to avoid any confusion. Other implementations can be used, too, provided they’re compatible with Bitcoin Core.

Full nodes are integral to Bitcoin’s decentralization. They download and validate blocks and transactions, and propagate them to the rest of the network. Because they independently verify the authenticity of the information they’re being provided with, the user doesn’t rely on a third party for anything.

If a full node stores a full copy of the blockchain, it is referred to as a full archival node. Some users discard older blocks, though, in order to save space – the Bitcoin blockchain contains over 200GB of transaction data.

LIGHT NODES

Light nodes are not as capable as full nodes, but they’re also less resource-intensive. They allow users to interface with the network without performing all of the operations that a full node does.

Where a full node downloads all blocks to validate them, light nodes only download a portion of each block (called a block header). Though the block header is tiny in size, it contains information that allows users to check that their transactions are in a specific block.

Light nodes are ideal for devices with constraints in bandwidth or space. It’s common to see this type of node being used in desktop and mobile wallets. Because they can’t perform validation, however, light nodes are dependent on full nodes.

MINING NODES

Mining nodes are full nodes that perform an additional task – they produce blocks. As we touched on earlier, they require specialized equipment and software to add data to the blockchain.

Mining nodes take pending transactions and hash them along with other information to generate a number. If the number falls below a target set by the protocol, the block is valid and can be broadcast to other full nodes.

But in order to mine without relying on anyone else, miners need to run a full node. Otherwise, they can’t know what transactions to include in the block.

If a participant wants to mine but doesn’t want to use a full node, they can connect to a server that gives them the information they need. If you mine in a pool (that is, by working with others), only one person needs to run a full node.

HOW TO RUN A FULL BITCOIN NODE

A full node can be advantageous for developers, merchants, and end-users. Running the Bitcoin Core client on your own hardware gives you privacy and security benefits, and strengthens the Bitcoin network overall. With a full node, you no longer rely on anyone else to interact with the ecosystem.

A handful of Bitcoin-oriented companies offer plug-and-play nodes. Pre-built hardware is shipped to the user, who just needs to power it on to begin downloading the blockchain. This can be more convenient for less technical users, but it’s often considerably more expensive than setting up your own.

In most cases, an old PC or laptop will suffice. It’s not advisable to run a node on your day-to-day computer as it could slow it down considerably. The blockchain grows continuously, so you’ll need to ensure that you have enough memory to download it in its entirety.

A 1TB hard drive will suffice for the next several years, provided there isn’t any major change to the block size. Other requirements include 2GB of RAM (most computers have more than this by default) and a lot of bandwidth.

From there, the Running a Full Node guide on bitcoin.org details the process of setting your node up.

HOW TO MINE BITCOIN

In the early days of Bitcoin, it was possible to create new blocks with conventional laptops. The system was unknown at that point, so there was little competition in mining. Because activity was so limited, the protocol naturally set a low mining difficulty.

As the network’s hash rate rose, participants needed to upgrade to better equipment to stay competitive. Transitioning through various kinds of hardware, the mining industry eventually entered what we might call the Application-Specific Integrated Circuits (ASICs) era.

As the name might suggest, these devices are built with a specific purpose in mind. They’re extremely efficient, but they’re only capable of performing one task. So, a mining ASIC is a specialized computer that is used for mining and nothing else. A Bitcoin ASIC can mine Bitcoin, but can’t mine coins that don’t use the same algorithm.

Mining Bitcoin today requires significant investment – not only in hardware but also in energy. At the time of writing, a good mining device performs upwards of ten trillion operations per second. Although very efficient, ASIC miners consume tremendous amounts of electricity. Unless you have access to several mining rigs and cheap electricity, you’re unlikely to ever turn a profit with Bitcoin mining.

With the materials, however, setting up your mining operation is straightforward – many ASICs come with their own software. The most popular option is to point your miners towards a mining pool, where you work with others to find blocks. If you’re successful, you’ll receive part of the block reward proportional to the hash rate you’ve provided.

You can also choose to solo mine, where you work alone. The probability of generating a block will be lower, but you’ll keep all of the rewards if you create a valid one.

HOW LONG DOES IT TAKE TO MINE A BITCOIN?

It’s difficult to give a one-size-fits-all answer because there are a number of variables to consider. How quickly you can mine a coin depends on the amount of electricity and hash rate available to you. You’ll also need to factor in the costs of actually operating a mining device.

To get an idea of the revenue generated from mining Bitcoin, it’s recommended that you use a mining calculator to estimate costs.

WHO CAN CONTRIBUTE TO THE BITCOIN CODE?

The Bitcoin Core software is open-source, meaning that anyone can contribute to it. You can propose or review new features to be added to the 70,000+ lines of code. You can also report bugs, or translate and improve the documentation.

Changes to the software go through a rigorous reviewing process. After all, software that handles hundreds of billions of dollars in value must be free of any vulnerabilities.

If you’re interested in contributing to Bitcoin, be sure to check out developer Jimmy Song’s blog post on getting involved, or the Bitcoin Core website.

Bitcoin and Deflation

A Life in (Fiat) Recovery

Bitcoin is pristine, homogenous collateral

Bitcoin is just math.

A layman's guide to understanding money supply.

Episodes of hyperinflation.

Warning: This might change your life

Bitcoin is the best treasury reserve asset.

May the best currency win.

The great currency debasement of the Roman Empire