Hyperinflation?

Published on 08/12/2021 01:34 AM

This was authored by Mark Moss and originally sent out through his newsletter.

When I talk about hyperinflation, people seem to think it’s a rare occurrence.

And that it can’t happen here.

Then, I remind them of all the times it happened in the last century alone ...

1. Chile

When? 1973-1975

What? Annual inflation reached 746.29%

Why did it happen? Salvador Allende nationalized companies and mines and took private land to give to workers. He also printed money to keep the economy stable.

How did they get out? General Augusto Pinochet came into power and sold government-owned companies and instituted the peso (a new currency).

2. China

When? 1948-1949

What? China hit a monthly inflation rate of 2,178%. The highest denomination being printed was 6 billion yuan! That’s like a 6 billion dollar bill.

Why did it happen? China took over the banks and switched from silver to fiat currency. They then used the currency to pay off their debt and continued printing money during the civil war and the war with Japan.

How did they get out? They adopted a new currency (the renminbi) - and inflation cooled off.

3. Argentina

When? The 1980s

What? Annual inflation hit 12,000%. One peso in 1992 was equal to 100 billion pre-1983 pesos.

Why did it happen? Heavy external borrowing. Once they got cut off, they devalued the currency to increase the trade surplus.

How did they get out? Argentina adopted the BB plan with new stabilization measures.

4. Greece

When? 1943-1946

What? Greece’s monthly inflation rate peaked at 13,800%.

Why did it happen? During and after WWII, they covered their expenses by printing money rather than taxing citizens.

How did they get out? Greece joined the international Bretton Woods system, fixing exchange rates linking international currencies to a new currency - the USD.

5. Germany

When? 1921-1923

What? At its worst, Germany’s monthly inflation rate hit 29,500%. 1 US dollar was worth 4.2 trillion marks in December of 1923.

Why did it happen? After WWI, Germany borrowed from other countries to pay their war debts, rather than tax citizens.

How did they get out? The government created an independent central bank and introduced a new currency - the rentenmark. This could be converted into bonds with gold value.

6. Nicaragua

When? 1987-1990

What? Annual inflation in Nicaragua hit over 30,000% in 1987.

Why did it happen? Debt from war, a drop in agricultural exports, and sanctions by the USA.

How did they get out? The end of armed conflict and the implementation of reforms by Violeta Chamorro eased inflation.

7. Bolivia

When? 1984-1985

What? Bolivia’s annual inflation rate hit 60,000%.

Why did it happen? Bolivia’s political instability led to a collapse of the export industry. As well, the government decided to print more money to cover the debt.

How did they get out? Victor-Paz Esnoro implemented monetary and fiscal changes and halted money printing. Bolivia also broadened its tax base and increased the prices of state-owned oil.

8. Yugoslavia

When? 1989-1994

What? The monthly inflation rate in Yugoslavia hit a whopping 313,000,000%. They started printing denominations as high as 500 billion.

Why did it happen? After sanctions from the UN, Yugoslavia started printing money left and right. The government used up their own hard currency reserves and began restricting citizens’ access to their savings accounts so they could take the money for themselves.

How did they get out? The government introduced a new currency - the Novi dinar - at an exchange rate of 1.3 million dinar:1 Novi dinar.

9. Hungary

When? 1945-1946

What? Monthly inflation hit 4.19 trillion%. That’s 41,900,000,000,000,000%. The highest denomination they were printing at the time was 100 quintillion pengő.

Why did it happen? Much like other countries on this list, the severe inflation was caused by an inability to pay off war debts. Plus, the Hungarian government heavily subsidized the private sector.

How did they get out? The government originally tried to combat inflation by introducing a new currency, but that currency was equal to 2x1021 pengő. They switched to a new regime in 1946, which paid their workers unethical wages. Hungary eventually switched to the forint and stabilized its credit system.

And last, but CERTAINLY not least…

10. Zimbabwe

When? 2000-2009

What? Zimbabwe’s annual inflation reached 516 quintillion%. That’s 516 followed by 21 zeros! They were printing off bills worth 100 trillion so the citizens didn’t have to carry garbage bags full of cash.

Why did it happen? President Mugabe’s policies allowed for out-of-control government spending.

How did they get out? A new currency. Zimbabwe adopted the South African rand and the US dollar, which eased inflation.

Notice any commonalities?

The 4 I see are money printing, debt, and war. With the only savior being a new currency.

Let’s look at the US …

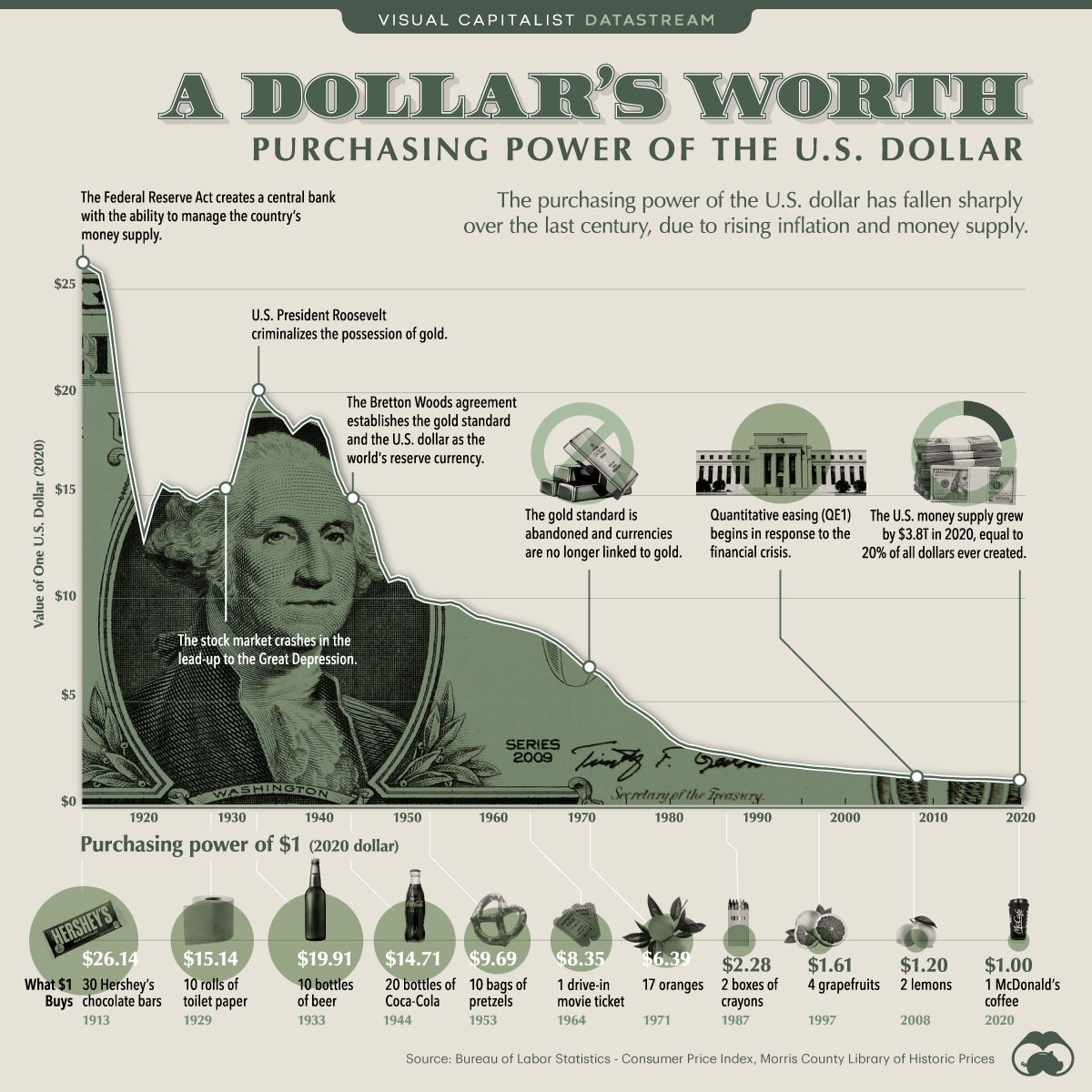

Money printing? Yup. 40% of all USD in circulation was printed in the last year alone.

Debt? Yup, nearing $29 trillion.

War? We’re always at war somewhere.

And, of course, we’re already seeing signs of inflation - with 5.4% inflation rates in June alone.

All of which points to the possibility of hyperinflation.

When that comes, the only way out will be a new currency.

I’m hoping it’s Bitcoin.

Ready to protect yourself?

Click here to get started.

Bitcoin and Deflation

A Life in (Fiat) Recovery

Bitcoin is pristine, homogenous collateral

Bitcoin is just math.

Bitcoin Basics

A layman's guide to understanding money supply.

Warning: This might change your life

Bitcoin is the best treasury reserve asset.

May the best currency win.

The great currency debasement of the Roman Empire