Welcome to the World of Deflation #1

Published on 07/18/2021 01:04 PM

Welcome to the World of Deflation

To be welcomed into the world of deflation, you must first understand both inflation and deflation. Let us start with inflation.

Inflation

The definition of inflation varies between Keynesian and Austrian economists. Keynesians measure inflation through something called the consumer price index (CPI). CPI tracks the price of a basket of goods and services over time. Austrians measure inflation purely based on changes in the money supply. The average historical inflation rate varies significantly between the two approaches (3.42% using CPI and 6.34% using M2). Regardless of which definition you use, inflation is rising fast. Exhibits 1, 2, 3, and 4 show CPI and M2 growth.

Exhibit 1: CPI Index

Exhibit 2: CPI Growth Rate Annualized (%)

Exhibit 3: M2 Money Stock

Exhibit 4: M2 Money Stock Growth Rate Annualized (%)

It is worth noting that the historical stock market return is around 7% per year (similar to the historical average growth rate of M2). Many investors think they are making a profit when investing in stocks, but they are merely keeping up with inflation. Over the long run, stocks are not overvalued or undervalued, they simply adjust to the new money supply. Exhibit 5 shows the relationship between the two.

Exhibit 5: M2 Money Stock and S&P 500

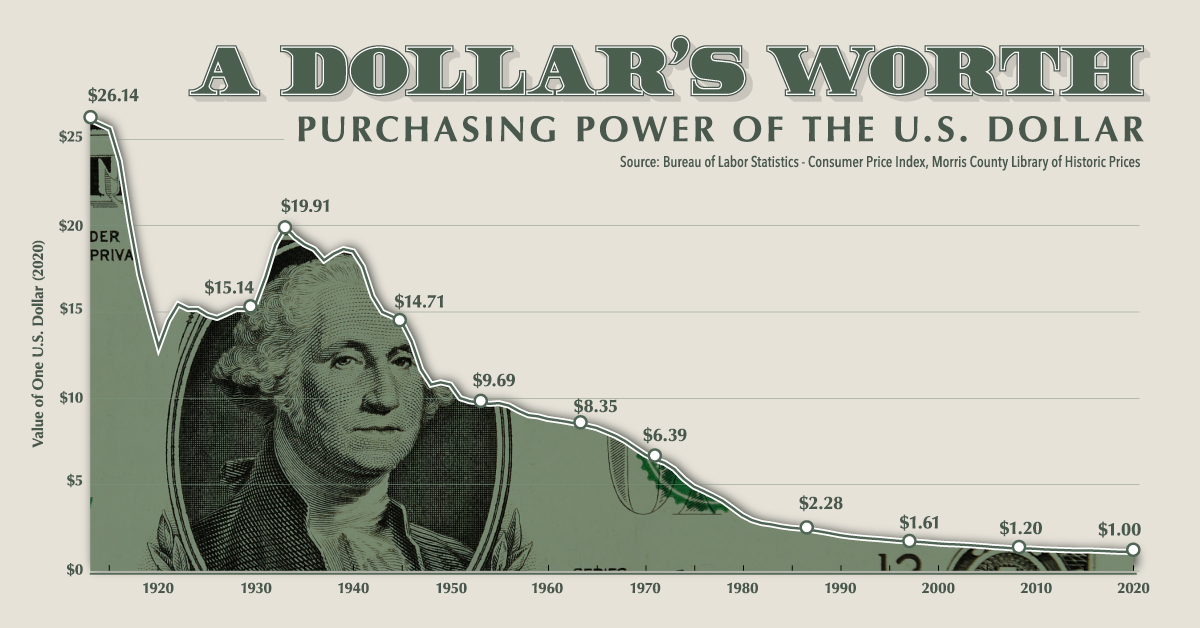

Inflation erodes the value of a currency (as depicted in Exhibit 6). The process can take many years, as it has in the United States, or rapidly in countries like Zimbabwe or Venezuela. Inflation is a hidden tax on your savings, it is like a thief in the night pickpocketing you while you sleep. You cannot see it until it is too late. Inflation is the reason for the widening wealth inequality. Inflation is why you cannot save up enough money for a house. Inflation is a disease, and the only cure is deflation.

Exhibit 6: Purchasing Power of the U.S. Dollar

Source: https://www.visualcapitalist.com/purchasing-power-of-the-u-s-dollar-over-time/

Deflation

Deflation is the opposite of inflation. Keynesians would define deflation as an increase in purchasing power of money as prices fall. Austrians would argue it is the decreasing supply of money that leads to prices falling. No matter the definition, deflation benefits those who save in money (as you will see further down in the report). However, central authorities defame deflation since the system depends on perpetual inflation (a topic for another time). Bitcoin provides the best visual of deflation.

Exhibit 7: Bitcoin Inflation Rate and Price

Source: https://charts.woobull.com/bitcoin-inflation/

The beauty of Bitcoin is the hard cap of 21 million coins and programmed inflation schedule. Many Bitcoiners like to call this Number Go Up technology (NGU), and rightly so because the future supply and inflation rate is predetermined providing certainty. The price for certainty in a monetary asset is near infinity since no other asset cannot provide a similar guarantee. The supply of fiat currencies has zero certainties, as do precious metals.

Now that you have a general idea of inflation and deflation, you are welcome to the world of deflation. Below, you will find charts showing the power of deflation.

Chart 1: Median Sales Price for New Houses

Do you feel as if you cannot afford a house, even though you work hard? You are not alone, many millennials and Gen Z’ers feel the same way. Inflation is the primary cause of house prices going up. Again, what sticks out here is the historical average increase in housing is 6.17%. This is similar to the growth in M2. Housing is not getting more expensive; the currency is eroding in value. What is the solution? How can you protect yourself against this? Bitcoin.

Chart 2: Median New Houses Priced in Bitcoin

When you price a house in Bitcoin, you immediately see a rapid price decline. Over the last six years, the price of a house fell from 1300 BTC to 8 BTC. This is the power of deflation at work.

Chart 3: Average Amount Financed for New Car Loans

The average cost of a new car has increased 36% or about 2.77% per year since 2008. It may not seem like much, but the problem here is that most people save in bank savings accounts that yield on average a whopping 0.06%. And the real rates of bank savings accounts are negative since they do not keep up with inflation. Using the most recent CPI figure of 10.8%, the real rate on a savings account is negative 10.74%. You are tremendously screwed! Enter Bitcoin.

Chart 4: New Cars Priced in Bitcoin

The price of a new car has decreased from 110 BTC to 1 BTC since 2015. If you want to save up for a car, do not save in a bank savings account. You are burning money. Save in Bitcoin.

Chart 5: Sirloin Steak Per Lb.

Do you enjoy eating steak? You may not be able to afford it for much longer if you continue to save in fiat currency. The price of steak has roughly tripled since 1990.

Chart 6: Sirloin Steak Priced in Bitcoin

Meanwhile, the price of steak has collapsed in Bitcoin terms. Stack sats, eat steak.

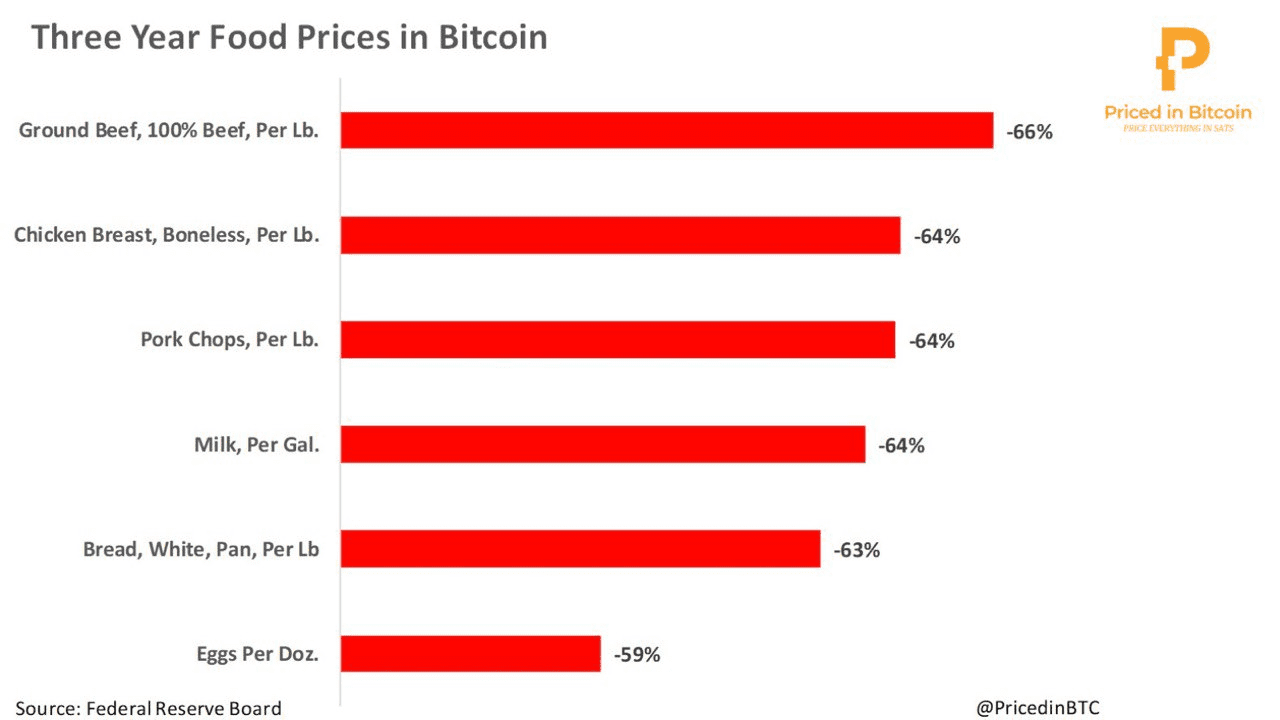

Chart 7: Three Year Food Prices in Bitcoin

Source: https://fred.stlouisfed.org/

All food prices are collapsing in Bitcoin.

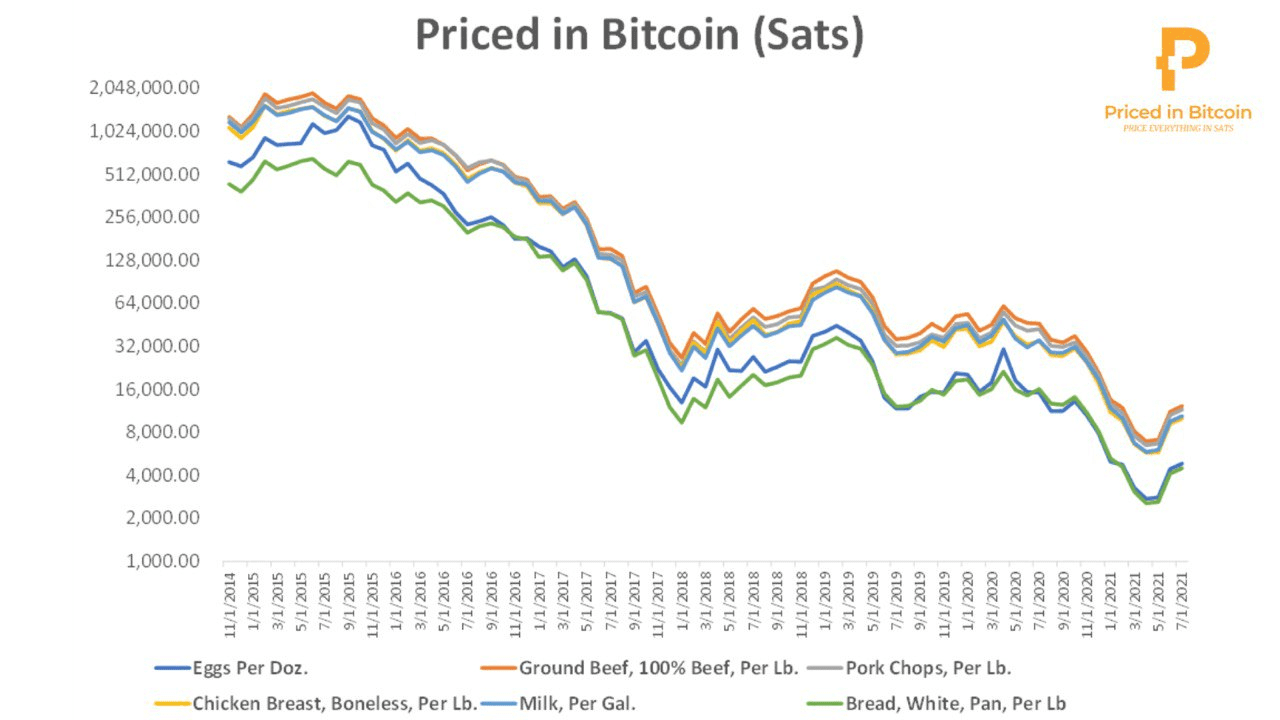

Chart 8: Historical Food Prices in Bitcoin

Another longer-term look at food prices in Bitcoin; everything is more affordable when you save in Bitcoin.

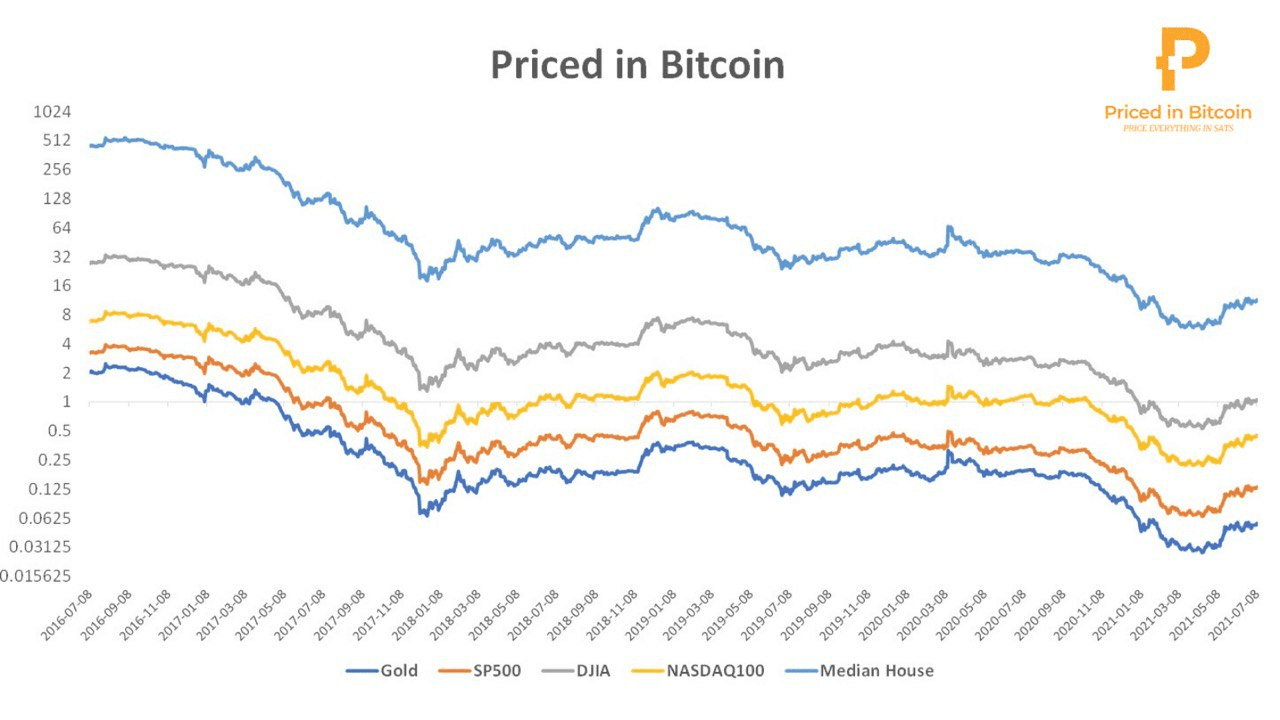

Chart 9: Assets Priced in Bitcoin

Not only are food prices collapsing in Bitcoin, but so are the popular store of value assets.

Now that you entered the world of deflation, we hope you stay here. Bitcoin is a deflationary asset. The supply is decreasing, while demand is increasing. Bitcoin is superior to gold and stocks in beating inflation. Number Go Up technology is not a joke. Stack sats and hodl.

Thank you for reading,

Note: I am not a writer, I am better with charts than with words.

If you enjoyed this commentary, please share and check out pricedinbitcoin21.com and follow @pricedinbtc on Twitter. Priced in Bitcoin (the site) denominates various assets in Bitcoin, including precious metals such as Gold and Silver, public companies such as Apple and Tesla, ETFs (Exchange Traded Funds) such as Select Sector SPDR ETFs and iShares Treasury and Corporate Bond ETFs.

A Life in (Fiat) Recovery

Bitcoin is pristine, homogenous collateral

Bitcoin is just math.

Bitcoin Basics

A layman's guide to understanding money supply.

Episodes of hyperinflation.

Warning: This might change your life

Bitcoin is the best treasury reserve asset.

May the best currency win.

The great currency debasement of the Roman Empire